Donald Trump and the Great Casino Heis

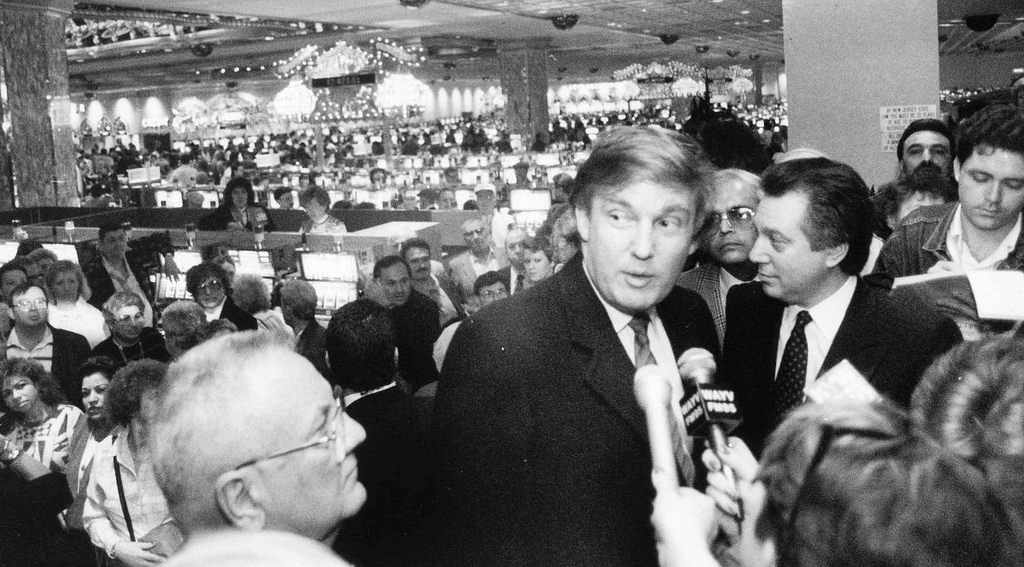

Trump in the mid-1980s had unwisely gotten in on the top of the casino wave in Atlantic City. When gambling was legalized in Atlantic City in 1978, Las Vegas was the only other place where gambling casinos were legal and they 2,000 miles away from the East Coast. At one point there were fifteen casinos in Atlantic City of which Donald Trump was the greatest presence with ownership of three casinos. Unfortunately, other states began legalizing gambling on their home turfs which began to slice into the gambling crowds in Atlantic City. Trump crusaded unsuccessfully against competitors opening elsewhere in the New York metropolitan area.

As a consequence, Trump’s business empire began to unravel. He had tried to dominate the casino biz by owning three casinos. A significant amount of debt was garnered from financing the Taj Mahal, one of Trump’s casinos acquired in 1988. Mark Hoffberg, a Wall Street Journal financial analyst, realized that Trump had taken on too much debt on acquiring his casino properties. Trump could not sustain the payments on the high-interest debt because of the risks involved. Hoffberg realized that when the Taj Mahal Casino Resort opened to the public in the summer of 1988, the crowds would thin out with the approach of winter. As a result, revenues would no longer be able to pay for the operations and the interest on the debt.

Trump’s response was classic Trump. Firstly, he had Hoffberg fired from the Wall Street Journal. Secondly, when Hoffberg’s analysis came true. Secondly, Trump began finding fault with the contractors and refused to pay for supposedly “inferior work.” Finally, he blamed three business associates, who had only months he had praised for hard and diligent work. They had died in a helicopter crash in the course of working for Donald Trump. No longer useful and conveniently dead, he declared they were responsible for the failure of the Taj Mahal.

Trump almost filed for personal bankruptcy in 1990, due to massive personal and business debts. At one point, Trump was put on a monthly allowance of $450,000 by his creditors. His father bailed him out by lending him hundreds of millions of dollars.

But then he discovered he had become too big to fail. His creditors did not want to take over his properties and manage them. In 1990, nearly $1 billion in personal debt, Trump reached an agreement with bankers allowing him to avoid declaring business bankruptcy. In 1991, the Trump Taj Mahal files for Chapter 11 bankruptcy protection. In 1992, The Trump Plaza and the Trump Castle casinos file for bankruptcy. On November 21, 2004 – Trump Hotels & Casino Resorts Inc. files for Chapter 11 bankruptcy.

Even in 2004, as Trump’s casino business was in bankruptcy again, The New York Times noted—in words that would ring true during his campaign years later—“His name has become such a byword for success that even the most humiliating reverses barely dent his reputation. Taking advantage of his reputation, he then sold shares in a public company that bought his distressed properties from him. On February 13, 2009, Trump announced his resignation from his position as chairman of Trump Entertainment Resorts. Days later, the company filed for bankruptcy protection. He escaped debt and bankruptcy as he let the company go broke. As he declared, “I like to win.” Donald Trump had become a master at stealing money with a pen and blaming others for his difficulties.

NYC Walks Blog 82  t © 2019 by Dr. Philip Ernest Schoenberg

t © 2019 by Dr. Philip Ernest Schoenberg